Buy Car in the Business Name From a Private Party

7600+ Cashless

Network Garages**

Overnight Car

Repair Services¯

What is Third Party Car Insurance?

It is a cover that protects you against liabilities arising from damage, injury or loss to a third party. The same could be a person or a third party property that sustained damage because of your car. As stipulated in the Motor Vehicles Act 1988, this is a mandatory cover and all motorists must be insured against their liability to other people or property.

6 reasons why HDFC ERGO's Third Party Car Insurance is a must have!

Premium starting at Just ₹2072*

Easy on your pocket and no legal hassles! Need we say more?

7600+ cashless garages

No matter where you are our wide network of cashless garages are at your service

#1.5 Crore+ Happy Customers

We are proud to say we've put smiles on 1.5 Cr + customers and counting, so join the club!

Buy Policy Online in Less Than 3 mins

We guarantee convenience while you secure your car from third party liabilities

Zero Documentation & Instant Policy

Ditch the paperwork and forget the long queues because now securing your car is quick & easy

Personal accident cover upto Rs. 15 Lakhs

Safety comes first and this cover acts as your shield in the unfortunate event of injuries due to an accident

Third Party Liability car policy inclusions and exclusions

- What is covered?

- What is not covered?

Personal Accident

Your safety is our priority, in case of injuries due to a car accident we cover your treatment charges.

Third Party Liability

Caused injury to another person? We cover the medical needs for injuries sustained by a third party person.

Third Party Property Damage

Collided with a third party vehicle or property? We cover up to Rs 7.5 lakhs towards third party property damages.

Not having a comprehensive policy can leave you vulnerable to risks in turn causing huge financial losses!

Why do you need Third Party Cover?

This is a pertinent question considering that not having a valid third party car insurance policy can lead to hefty fines and even confiscation of your driving license. Hence it is essential to have at the very least a third party insurance policy. Having said this, it is also beneficial because it is cost effective when compared to other plans and also saves you from legal hassles. Adding to this a personal accident cover of upto Rs. 15 lakhs acts as your safety net.

Filing a claim is now as easy as 1,2,3,4!

Filing a claim just got easier with our 4 step process and a claims settlement record that will ease your claim related worries!

-

Upload Documents

Ditch the paperwork! Register your claim and share required documents online.

-

Self Survey/ Digital Surveyor

You can opt for self inspection or an app enabled digital inspection by a surveyor or workshop partner.

-

Claim Tracker

Relax and keep track of your claim status through the claim tracker.

-

Claim Approved

Take it easy while your claim is approved and settled with the network garage!

Say goodbye to claim related worries!

If filing a claim was a cakewalk with our 4 step process, our claims settlement record will put to ease any claim related worries you may have. The word 'claims' makes many break into a sweat but with HDFC ERGO's claim settlement records of settling 50% car claims the same day to our express theft claim settlement, you can wipe that sweat from your brow. Still hesitant? Here are 5 reasons why we call our claim process quick and easy:

Reason 1

WhatsApp claim intimation

Making a claim is a cakewalk as we are just a chat away, all you've got to do is message to intimate a claim

Reason 2

AI enabled motor claim settlement

Our AI enabled tool IDEAS enables a faster and hassle free motor claim experience

Reason 3

Overnight repair service

Now no more losing precious sleep over car repairs with the overnight repair service your car is ready for commute by morning

Reason 4

7600+ cashless network garages

Our network spans pan India meaning no more carrying cash and worrying about help even in the remotest corner

Reason 5

Paperless Claims Processing

No more piles of paperwork or standing in serpentine queues, documents processing is now 100% paperless at HDFC ERGO

- Reason 1

- Reason 2

- Reason 3

- Reason 4

- Reason 5

WhatsApp claim intimation

Making a claim is a cakewalk as we are just a chat away, all you've got to do is message to intimate a claim

AI enabled motor claim settlement

Our AI enabled tool IDEAS enables a faster and hassle free motor claim experience

Overnight repair service

Now no more losing precious sleep over car repairs with the overnight repair service your car is ready for commute by morning

7600+ cashless network garages

Our network spans pan India meaning no more carrying cash and worrying about help even in the remotest corner

Paperless Claims Processing

No more piles of paperwork or standing in serpentine queues, documents processing is now 100% paperless at HDFC ERGO/div>

All Set to Buy A Car Insurance Plan? It will just take a few minutes!

What Makes HDFC ERGO's Car Insurance Stand Out

Easy on your pocket

With premium starting at Just ₹2072*, we offer premiums that don't burn a hole in your wallet while offering maximum benefits. From no-claim bonus upto 50% to discounts on installing anti-theft features, we promise savings galore. And if that's not all, you can now get massive discounts of upto 70% while securing your car.

Cashless assistance

Hiccup in the journey? Now no more worrying about cash to get your car fixed while you are stranded in the middle of nowhere. With our 7600+ cashless garages pan India help is never too far, our widespread network of cashless garages will be your friend in need. To add to this our 24x7 roadside assistance ensures help is just a phone call away, and your car is taken care of anywhere anytime.

Growing family of happy customers

With over #1.5 Crore+ happy customers, we are proud to say that we've put smiles on a million faces and counting. The testimonials from our ever growing family of customers are heartwarming to say the least. So toss your car insurance related worries aside and join the happy customers club!

No more sleepless nights

Car needs repair but worried how you'll commute to office next morning? HDFC ERGO's Overnight repair service is here to save the day! We take care of minor accidental damages or breakdowns while you catch up on your sleep and get your car back in shape by morning. If this doesn't spell convenience, what does?

Making a claim is a breeze

We make sure that your claim experience is hassle free and swift. Paperless claims, self inspection option and our quick claim settlement record are a testimony to our promise of making the claim process a breeze for our customers. So say goodbye to claim related worries whether it is intimating a claim or waiting for it to get settled.

6 Factors that affect your Third Party Car Insurance Premium

As your car gets older your premium amount increases, the reason being an older car is more prone to wear and tear. Opting for a Zero Depreciation cover with your insurance plan will help reduce your premium marginally.

Insurance premium for cars that run on Diesel and CNG is more than the premium for cars running on petrol.

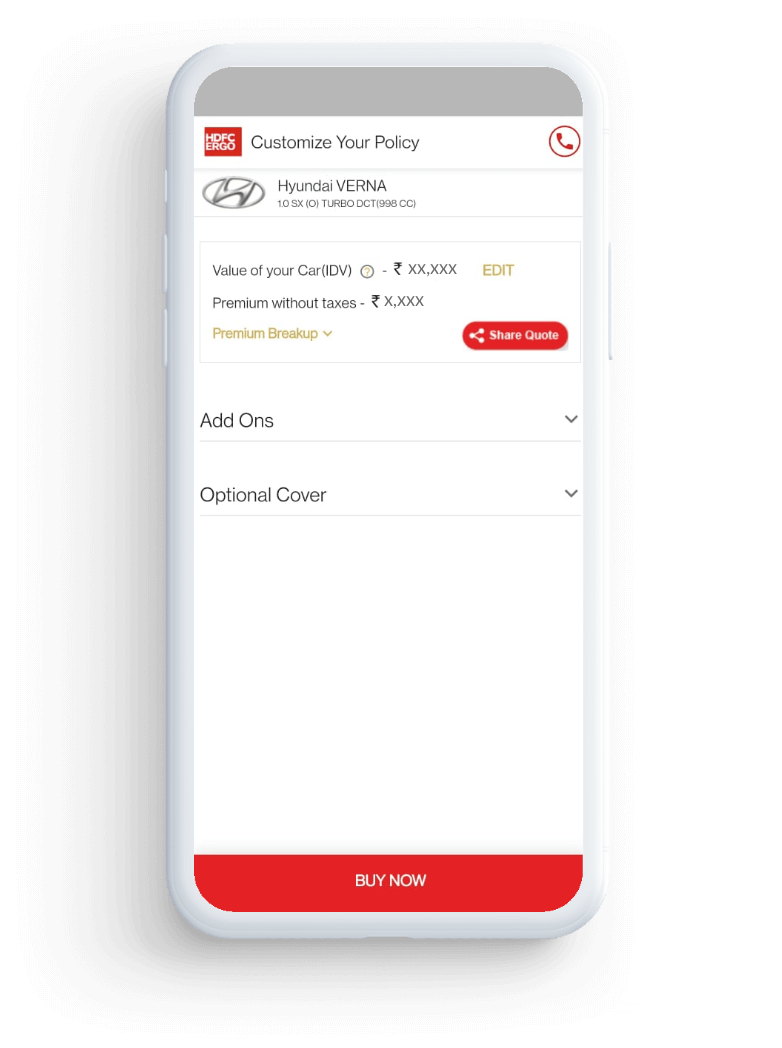

Insured Declared Value (IDV) is the one of the main component in determining the premium IDV is basically the current market value of car. If the current market value of the car is higher, the premium for its insurance will be more.

Another major factor affecting your car insurance premium is how safe your car is. Advanced safety features like airbags, ABS, collision warning systems, anti-theft alarms, and automatic braking make your car less susceptible to theft and accidents hence reducing the premium amount.

Where you reside and park your car is also a factor that affects your car insurance premium. If you live in a region prone to vandalism or theft, your premium amount may be on the higher side to offset any potential losses.

Your premium will vary based on how expensive your car is. More expensive cars with a higher engine capacity (exceeding 1500cc), like luxury sedans and SUVs, will have higher premiums, while base car models with lower engine capacity (below 1500cc) will have lower premiums.

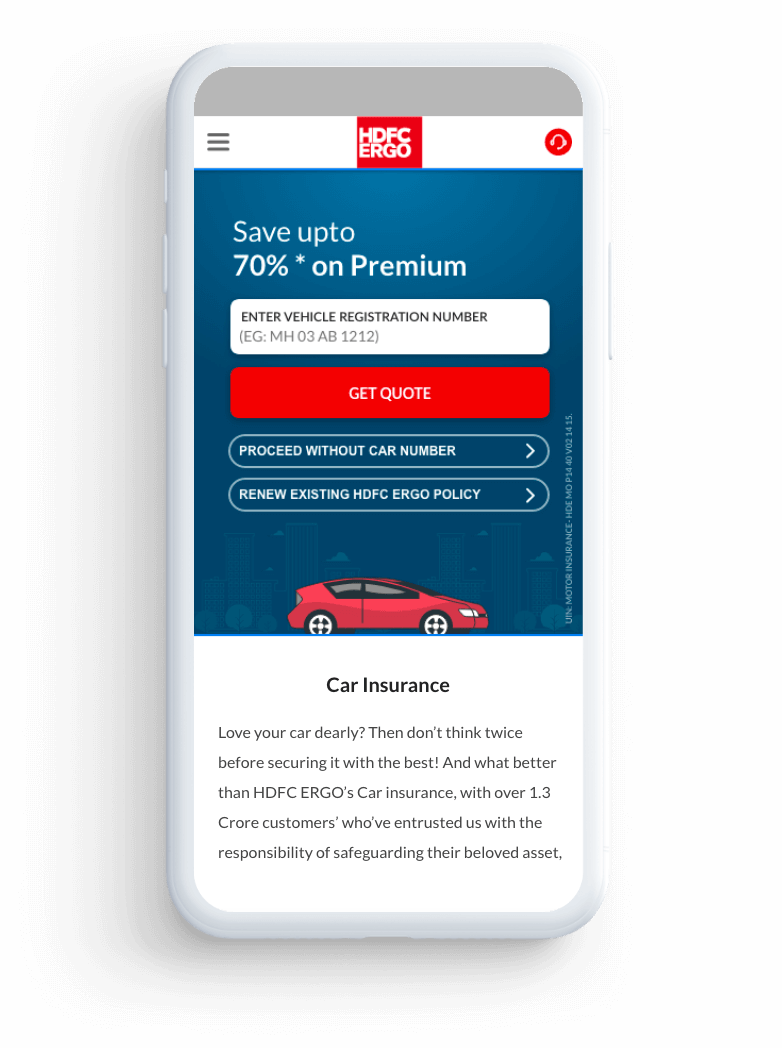

The how and why of buying Third Party car insurance online

STEP 1

Enter your registration number

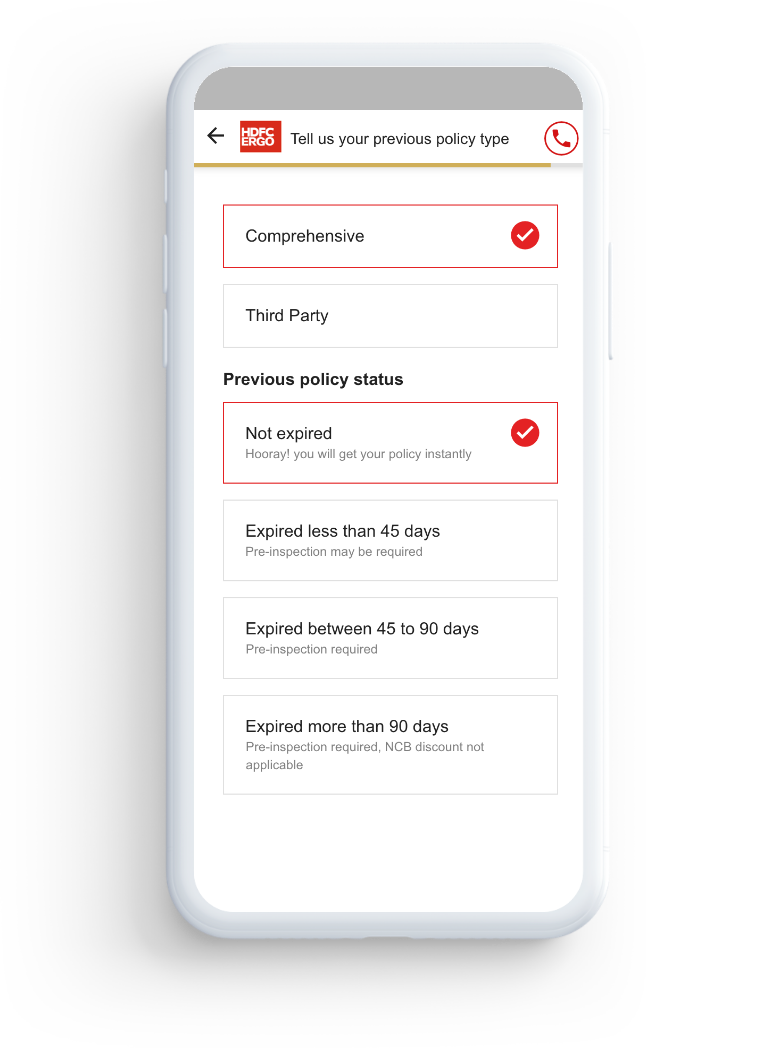

STEP 2

Select your policy cover*

(In case we are not able to auto fetch your vehicle details,

we will need just a few details of your vehicle - Make,

Select your policy cover*

(In case we are not able to auto fetch your vehicle details,

we will need just a few details of your vehicle - Make,

model, variant, registration year and registration city)

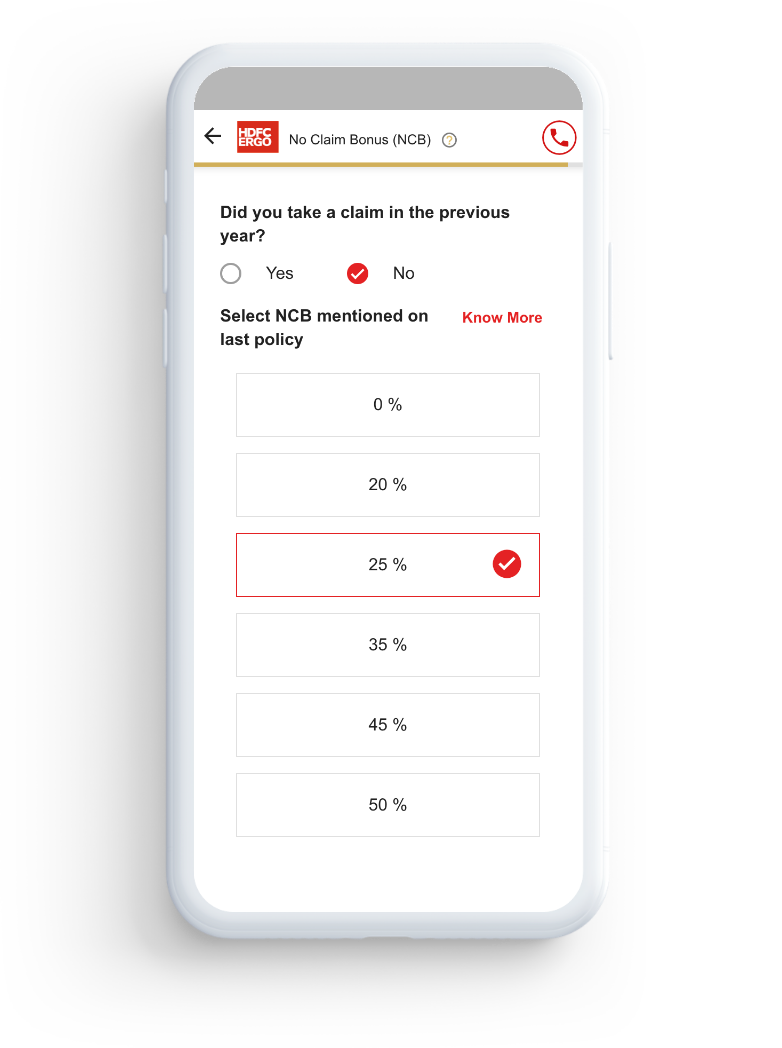

STEP 3

Provide your previous policy

and No Claim Bonus (NCB) status

STEP 4

Get your car insurance quote in an instant

Here's Why :

Experience true convenience by giving your car complete protection from the confines of your home all within 3 minutes.

Researching and knowing what your comprehensive car insurance policy entails helps you stay abreast of what's in store rather than being caught unaware.

It helps you save your hard earned money while you explore different combinations of add-ons, and other parameters that decide your premium amount.

Your simple guide to a third party cover premium calculator

The Insurance Regulatory and Development Authority (IRDA) regulates the third party car insurance premium on an annual basis. The value however is determined as per the cubic capacity of your car's engine. The third party car insurance premium for the current year is as follows:

| Engine Capacity of your car | Premium Amount |

|---|---|

| Up to 1,000cc | ₹2072 |

| More than 1,000cc | ₹2072 |

| More than 1,500cc | ₹2072 |

Why Third Party Car Insurance is not enough?

The debate between comprehensive car insurance and third party cover is a long standing one and has many facets to it. So while you put on your decision making cap it is important to take into account the disadvantages of having only a third party cover for your car.

- You lose out on the benefits and fortified coverage of add-on covers.

- There is no flexibility to customize your policy or IDV and a standard policy is applicable for all.

- It leaves you vulnerable to a multitude of risks and can result in regret when you have to shell out money from your own pocket in the event of own damage.

7600+** Network Garages

Across India

Find Your Nearest Cashless Garage

Hear from our happy customers

RUCHI SAHANI

Private Car Comprehensive Policy

My car had got stolen but fortunately it was insured with HDFC ERGO. The fast track claim settlement and fabulous claims team ensured my claim was settled quickly and easily. I can never even think of getting my other cars insured with any other company except HDFC ERGO.

DHEERAJ TIWARI

Private Car Comprehensive Policy

Excellent service by HDFC ERGO with special mention of the claims team. I got my vehicle before the time committed to me and in an excellent condition and the way my claim was dealt with, is really commendable. I would recommend a HDFC ERGO car insurance policy.

P SARATH CHANDRA

Private Car Comprehensive Policy

Thank you for making my car insurance purchase hassle-free. The service I received was commendable, with special mention to customer support team who patiently answered all my queries and ensured my doubts were cleared. Even in this pandemic situation, HDFC Ergo made sure I had a memorable buying experience.

ARUNCHANDRA SHETTY

Private Car Comprehensive Policy

I was pleasantly surprised with the smooth and seamless process and also the speed at which the service was delivered. Excellent service, only suggestion I have is to keep the app updated , so that the customer can get all the status and progress of the case.

SAIFUDDIN SIDDIQUI

Private Car Comprehensive Policy

I have had a great experience in my dealings with HDFC ERGO and I feel it is the best insurance company. They are synonymous with being efficient, hassle free and fair and I highly recommend HDFC ERGO to all my friends and family.

SHIVSHARAN MALI

Private Car Comprehensive Policy

The claim settlement process was smooth and only reiterated the fact that HDFC ERGO's services are excellent. Despite the COVID 19 situation and offices being closed which caused a little delay, my experience was hassle-free and I will continue to be a customer of HDFC ERGO in future too.

Frequently asked questions

Generally, basic third party insurance covers:

● Injury caused to the third party,

● Damage to the property or vehicle of third party and

● Death of a third party caused by an insured four-wheeler

At HDFC ERGO, we provide you with additional personal accident as well.

No, just third-party insurance coverage is not enough. As per Motor Vehicles Act, 1988, along with third-party insurance, personal accident cover is also mandatory. Therefore, HDFC ERGO's third-party insurance policy includes personal accident cover for the owner or driver's injury or unfortunate death.

A few differences between the two are listed down in a table below:

| Particulars | Comprehensive Policy | Third-Party Policy |

| Coverage | Gives overall coverage against accident, natural calamities, theft, personal accident cover and third-party liability. | Covers only third-party liabilities such as damage to third-party property or vehicle and injury/death of a third party. |

| Requirement | It is not mandatory. | It is mandatory as per Motor Vehicles Act, 1988. |

| Premium | Premium is higher because of broader coverage. | Premium is low due to limited coverage. |

A comprehensive policy would be a better choice. Here at HDFC ERGO, we offer you the best of both policies.

Some of the benefits of having third party car insurance policies are pointed out below:

● Legal compliance: Helps you comply with the legal requirement.

● Easy to buy: You can buy a policy within 3 minutes from our website/app.

● Cost-effective: The premium of third-party insurance is low.

● Liability coverage: You need not worry about any liability against third-party damage.

No, you cannot skip buying third-party car insurance coverage. It is a mandatory requirement as per Motor Vehicles Act, 1988. Even in a comprehensive insurance policy, third party liability is included.

After the accident, you need to intimate the insurance company within 36-48 hours. The inspection and settlement procedure begins right after you bring it to the notice of the insurance company. At HDFC ERGO, we offer you 100% paperless claim processing.

Every movable asset goes through daily wear-tear that causes its value to depreciate over time. Zero depreciation cover is an add-on that insures against such depreciation of your four-wheeler.

Since a third-party insurance policy does not accommodate add-ons, you cannot get zero depreciation cover under your third-party car insurance.

The insurance company bears the major claim except for a small portion of the claim that the policyholder has to bear. This amount is called a deductible. But in the case of third-party car insurance, there is no deductible involved since damage to the customer's four-wheeler is not included in the policy.

Yes, you can buy third-party insurance online. HDFC ERGO offers you zero documentation, instant third-party car insurance policy. Visit our website to buy one in less than 3 minutes.

No, you cannot include add-ons in a third-party insurance policy. To include add-ons in your policy, you can opt for a comprehensive car insurance policy for wide coverage.

You need the following documents to file a claim on third party insurance:

● Copy of FIR filed at the nearest police station

● If you have any witnesses, their names and contact details.

● Pictures and videos of the sight of the accident.

● Details of the third party involved such as name, vehicle number, contact details, policy details, etc.

Yes, a third party car insurance will cover your losses against third party liability even if someone else was driving your car at the time of the accident, provided the following conditions are fulfilled:

● The driver must be above legal age permitted to drive

● The driver holds a valid driving license at the time of the accident

● The driver was not under the influence of alcohol or drugs.

A ₹ 5 coin is the best substitute of tire depth gauge for measuring the remaining tire depth!

Awards & Recognition

ICAI Awards 2015-16

ICAI Awards 2015-16

SKOCH Order-of-Merit

SKOCH Order-of-Merit

Best Customer Experience

Best Customer Experience

Award of the Year

ICAI Awards 2014-15

ICAI Awards 2014-15

ICAI Awards 2015-16

ICAI Awards 2015-16

SKOCH Order-of-Merit

SKOCH Order-of-Merit

Best Customer Experience

Best Customer Experience

Award of the Year

ICAI Awards 2014-15

ICAI Awards 2014-15

Last updated: 2021-11-09

View all awards

Buy Car in the Business Name From a Private Party

Source: https://www.hdfcergo.com/car-insurance/third-party-insurance

0 Response to "Buy Car in the Business Name From a Private Party"

Post a Comment